Nampak jelas Permodalan Nasional Berhad (PNB) yang menganjurkan skim Amanah Saham Bumiputera (ASB) telah melakukan perakaunan kreatif dalam memutuskan pengagihan pendapatan bagi tahun kewangan berakhir 31 Disember 2022. Itu pun baik sedikit saja daripada tahun lalu dan yang kedua paling rendah dalam sejarah. Ada tiga komponen dalam pulangan tersebut iaitu pulangan asas sebanyak 3.35 peratus, bonus 1.25 peratus dan bonus tambahan 0.50 peratus.

Bagaimanapun, bonus tambahan dihadkan kepada maksimum 30,000 unit yang pertama saja. Inilah unsur perakaunan kreatif yang saya maksudkan itu. Kita ambil contoh pelabur yang ada 30,000 unit kerana sehingga ke tahap itulah sajalah seseorang mendapat pulangan maksimum. Selepas itu tidak ada lagi bonus tambahan. Dalam bentuk pulangan (dividen), dia akan dapat RM1,005, bonus RM375 dan bonus tambahan RM150 bagi menjadikan jumlah kesemuanya RM1,530.

Malangnya tidak ramai pelabur yang ada pelaburan sebanyak itu. Menurut ahli ekonomi dan penyelidik Dr Muhammed Abdul Khalid, yang memetik perangkaan PNB, sebanyak 76 peratus pelabur hanya ada purata RM590 dalam akaun mereka. Ini bermakna mereka dapat RM30.08 saja.Kalau kita banding jumlah pembayaran sebanyak RM8.9 bilion dengan 10.6 juta pelabur yang layak, purata agihan hanya RM839.62 seorang.

Menurut Dr Muhammed lagi, 80 peratus pelabur ASB mengusai hanya empat peratus daripada keseluruhan dana skim tersebut manakala 10 peratus menguasai lebih 80 peratus daripada modalnya. Demikianlah tidak seimbangnya pelaburan antara golongan berada dengan tidak berada.Walaupun prestasi dan pulangan ASB mengatasi saluran pelaburan lain seperti perniagaan saham dan simpanan tetap, namun nilai purata pelaburan terlalu kecil untuk memberi pendapatan yang bermakna kepada majoriti pelabur.

Dalam keadaan ekonomi global yang mencabar, kemampuan orang ramai menabung merosot. Sebaliknya banyak yang menjual pelaburan dan menarik keluar simpanan untuk menampung kos sara hidup akibat pengangguran dan kenaikan harga barang pengguna.Suasana ekonomi dan prospeks penjanaan pendapatan diramalkan lebih muram tahun hadapan. Justeru itu kita juga perlu lebih teliti dan kritikal mengawasi serta menganalisis prestasi ASB khususnya dan PNB amnya.

Seperti yang telah saya sebut berulang kali, apa guna PNB mempunyai menara tinggi yang mencakar langit kalau agihan pendapatan kepada pelabur "ciput".Pengeruri PNB, Tan Sri Ariffin Zakaria, membandingkan pulangan ASB dengan prestasi Indeks Komposit Bursa Malaysia (KLCI) yang negatif sebanyak 6.7 peratus hingga 21 Disember dan kadar faedah simpanan tetap Maybank sebanyak 2.27 peratus.

Baguslah kalau aset bawah pengurusan PNB bertambah dan prestasi ASB lebih baik daripada Bursa Malaysia dan simpanan tetap dengan bank. Tetapi bagi majoriti Bumiputera yang melabur dalam skim amanah kelolaan PNB, itulah pelaburan tunggal yang mereka pilih, yakini dan mampu. Perbandingan tidaklah memberi erti yang besar kepada mereka. Mohon baca rencana saya dalam Sinar Harian semalam seperti dilampirkan untuk kefahaman lebih lanjut. Terima kasih. - A.Kadir Jasin

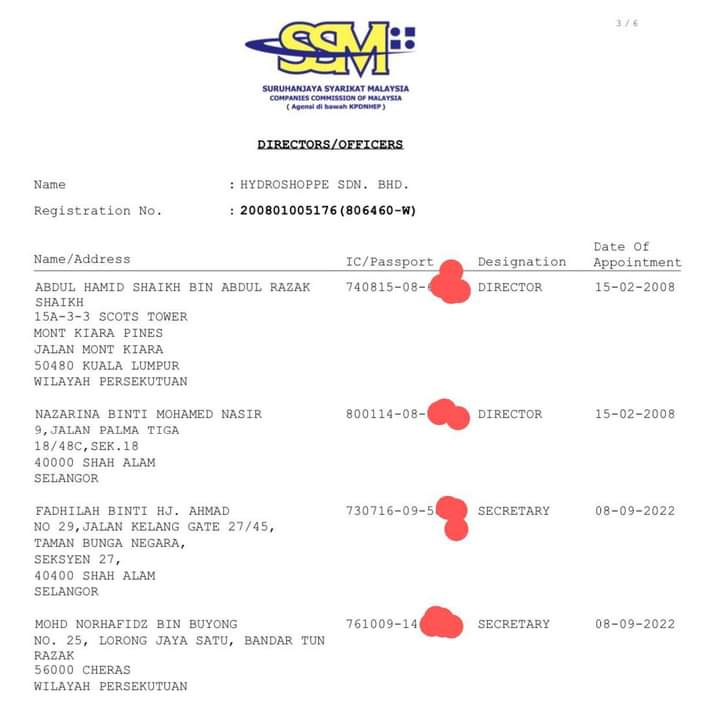

It seemed that this 👇👇👇 company acquired menara Kuala Lumpur

from TM just before GE15.It's really U grab,I grab,everybody grablah!!!

The real reason Mahathir attacks Anwar – Here’s what the ex-PM fears as the new PM started dismantles his cronies...

Many had never imagined Anwar Ibrahim would finally become the 10th Prime Minister of Malaysia last month. After all, he had been PM-in-waiting for 24 years – since 1998 when he was stunningly sacked by then-PM Mahathir Mohamad. In total, Anwar was persecuted with three prison sentences and 11 years in jail before walked free from prison after receiving a royal pardon.

He was imprisoned over dubious charges of corruption and sodomy – twice – by two prime ministers – Mahathir and Najib (who is serving his 12-year jail sentence for stealing RM42 million of SRC International money). Mr Anwar saw his chances slipping away as “Sleeping Beauty” Abdullah Badawi, “Corrupt” Najib Razak, “Racist Bigot” Muhyiddin Yassin and even “Turtle Egg” Ismail Sabri overtook him as PM.

While the majority of the so-called analysts had forecast a hung parliament post-15th General Election, none of them predicts Anwar would emerge the winner as most of them were betting that UMNO, Bersatu and PAS political parties would once again form a Malay-centric government. That explains why Bersatu president Muhyiddin and PAS president Abdul Hadi Awang are still squirming till today.

Mr Mahathir is another man who almost fell off his chair after learning that his protégé-turn-nemesis has become the prime minister. Like Muhyiddin and his religious extremist sidekick Hadi, the 97-year-old Mahathir didn’t expect Anwar-led Pakatan Harapan coalition would emerge as the biggest coalition in Parliament with 82 seats, let alone the idea that UMNO would support Anwar to form a unity government.

After serving twice as prime minister – first as the leader of then-ruling coalition Barisan Nasional for 22 years (from 1981 to 2003) and next as chairman of Pakatan Harapan after the 2018 general election – Mahathir was hoping to emerge as the kingmaker (even PM for the third time) based on the popular predictions that not a single political party or alliance will be able to command majority support.

Unfortunately, not only Mahathir-led Gerakan Tanah Air coalition lost all the 121 parliamentary seats it contested in the general election, the former premier and his son Mukhriz were among 369 parliamentary candidates who lost their deposits after obtaining less than one-eighth of the total number of votes. It was the most humiliating moment in the political career of Mahathir Mohamad.

It was both amusing and puzzling that the ex-PM could lose the Langkawi constituency, supposedly his stronghold. Yet, even after voters have expressed their loss of confidence in Mahathir, he has the cheek to prematurely judge the 1-month-old Anwar administration, expressing his lack of confidence in the new premier’s leadership. The old man should get a mirror from Shopee or Lazada.

Did Mahathir realize Pakatan Harapan won a whopping 5.8 million votes, more than 1 million votes than nearest competitor Muhyiddin-led Perikatan Nasional, which captured only 4.7 million votes? Perhaps Mukhriz has not told his father that the Anwar-led coalition has won 58 times more votes than Mahathir-led GTA (not to be mistaken as “Grand Theft Auto”), which only grabbed a pathetic 100,000 votes.

Apparently, Mahathir is using the 1997-1998 Asia Financial Crisis as his excuse to justify the lack of confidence in PM Anwar’s ability to face the current economic downturn. In an interview with Malay language newspaper Berita Harian, Mahathir has also raised the laughable concern that the new PM appeared to be preoccupied with maintaining support in the Parliament.

Perhaps the senile Mahathir didn’t get the memo that Anwar has already proven his legitimacy (unlike Mahathir’s lieutenant Muhyiddin) when the new premier easily won the motion of confidence in Parliament with two-thirds majority support. In fact, it was Anwar who bravely pushed for the vote of confidence on Nov 24, the same day he was sworn in as the 10th Prime Minister.

None of previous premiers – Najib Razak, Muhyiddin Yassin, or Ismail Sabri – whom Mahathir fully or partially supported had ever tabled a motion of confidence during their respective administration. Mahathir should stop thinking people are stupid to realize that he was one of the traitors who approved the “Sheraton Move”, the political coup that toppled the Pakatan Harapan government after just 22 months in March 2020.

Mahathir’s latest claim that Anwar, who was his deputy from 1993 to 1998, had failed to solve the country’s economic problems some 25 years ago because Anwar was ready to subscribe the World Bank and the International Monetary Fund (IMF) recommendations is not entirely true. Exactly how does Mahathir know for sure that the alternative methods won’t work?

The ex-PM said – “When I was the prime minister, I went on holiday for two months and he assumed responsibility as acting prime minister. But he couldn’t resolve the economic problems. The economic crisis happened and the Ringgit dropped in value. I believe that would have caused us to go bankrupt and unable to execute economic policies.”

Mahathir bragged that it was he who had saved the country. Of course, he was referring to his brilliant move in fixing the Ringgit at RM3.80 against the U.S. dollar. At its worst level, the local currency plunged to a record RM4.885 per dollar in 1998. The pegging was heavily criticised, but even the World Bank and IMF acknowledged the policy stopped fluctuations in the value of the Ringgit.

However, it’s also true that countries in the region like South Korea, Indonesia and Thailand that subscribed to the IMF way of handling the crisis have emerged successful without taking the same currency pegging approach. A prominent feature of the IMF packages for the Asian countries was structural reform in the financial and corporate sectors, aimed at restoring market confidence and at improving growth prospects.

Between August 1997 and February 1998, the Malaysian Ringgit and the Thai Baht followed a remarkably similar pattern, but since then the Baht has recovered more lost ground than the Ringgit – suggesting that the IMF methods actually worked. At one time, as the Thai Baht and the Korean Won more or less halved their depreciation, the Ringgit started plunging again.

It was only when the Ringgit continued to drop like a rock, thanks partly to Mahathir’s attacks on currency speculator like George Soros and his refusal to reform monetary policies, that Malaysia decided to introduce capital controls including the pegging of Ringgit to the dollar effective October 1, 1998. What Mahathir doesn’t want people to know is the consequences of his solution.

While foreigners were welcome to take over ailing businesses in Thailand and Korea, Malaysia was interested in foreign direct investment but not in takeovers. As a result, cross-border mergers and acquisitions in Korea increased from US$1.4 billion in 1997 to US$ 6.3 billion in 1998 and total foreign direct investment rose from US$2.8 billion to US$5.1 billion.

Likewise, Thailand saw its FDI jumped from US$3.7 billion to US$7.0 billion, whereas net foreign direct investment in Malaysia fell from US$5.1 billion to US$3.6 billion. Investors were basically spooked and horrified by Mahathir’s anti-Western rhetoric. Today, the local stock market is still trading at less than 1,500 points, not much improvement from 1,300 points during the 1993 Super Bull Run.

Yes, in April 1993, the Malaysian stock market experienced its Bull Run. From a low of 645 points, the KLSE Composite Index hit its all time high of 1,332 in the first quarter of 1997, before it went kaput and ended less than 500 points in January 1998. And it was not a coincidence that the bull run happened when Anwar was serving as finance minister from March 1991 to September 1998.

What Mahathir also doesn’t want people to know after 25 years is the fact that the corrupt government of Barisan Nasional, first started with his leadership, has been abusing the provision in Section 26 of EPF Act 1991 to bail out cronies and families for decades. For example, during the 1997-1998 Asia Financial Crisis, PM Mahathir formed a RM60 billion fund, sourced mainly from EPF, to bail out tons of cronies.

As Mahathir’s privatization crumbled under the weight of incompetence, corruption and mismanagement during the crisis, companies owned by cronies like national sewerage concessionaire Indah Water Konsortium (IWK) was given soft “irrecoverable” loan amounted to RM1.4 billion, while MAS (Malaysia Airlines System) was also bailed out as the national airlines sat on a RM9.5 billion debt.

National carmaker Proton, which reported losses for so many years people had actually lost count, was repeatedly bailed out so that Mahathir’s pet project would not go belly-up. EPF suffered RM100 million losses when it was forced to cough up RM269.28 million on 81.6 million unsubscribed Time dotCom shares at RM3.30 – when the share was hovering between RM1.96 to RM2.10.

After raising RM6 billion bond to rescue light-rail transit operators PUTRA (Projek Usahasama Transit Ringan Automatik Sdn Bhd), which had defaulted its RM2 billion loan in 1999, the EPF was ordered to give RM600 million in yet another soft “irrecoverable” loan to STAR (Sistem Transit Aliran Ringan Sdn Bhd) simply because the companies belonged to Renong Bhd (UMNO’s former investment arm).

Other companies that enjoyed mega bailouts, just to name a few, included UEM, Malayan Banking, Bank Bumiputra, Sime Bank, KUB, Bank of Commerce, RHB Bank, Ekran’s Bakun Dam Project, Park May-Intrakota bus, Monorail, and even Konsortium Perkapalan Bhd – owned by Mahathir’s son Mirzan whose brilliant business acumen saw the company submerged in debts as much as RM1.7 billion.

It’s not hard to understand why Mahathir fiercely rejected the World Bank and IMF’s loans, which come with policies that could bankrupt his cronies and family members. Hilariously though, the man who actually bankrupts the country is none other than Najib, his favourite prime ministerial candidate whom had stolen tens of billions in the 1MDB scandal and had borrowed till the country hit RM1 trillion debts.

Since August 2015 at the peak of 1MDB scandal, Ringgit has effectively lost its value, trading more than RM3.80 to a US dollar and hasn’t looked back, even though then-PM Najib implemented the Goods and Services Tax (GST) effective April 1, 2015. The extra revenue from GST, averaging RM43 billion a year, wasn’t enough to impress the currency market.

Under the clueless, incompetent and corrupt regime of Muhyiddin and Ismail, both leaders whom Mahathir believed to be better than Anwar, the country further accumulated more than RM1.3 trillion debts. Worse, the Ringgit depreciated to RM4.74 to the greenback under Sabri’s watch. In essence, the Malaysian currency increasingly became worthless in the last 25 years – till Anwar was sworn in.

Today, within 1 month since Anwar took over, the Ringgit is trading at RM4.42 to the dollar. Exactly how does the new prime minister bankrupt the country when the confidence has returned to the local currency? In truth, Mahathir isn’t worried about Anwar’s ability to lead the country economically. He is actually terrified over Anwar’s ability to dismantle his web of cronies. He fears the truth will be unveiled.

Anwar’s first target on billionaire Syed Mokhtar Al-Bukhary – one of Mahathir’s biggest cronies – has sent shivers down Mahathir’s spine. Syed Mokhtar was ordered to immediately allocate RM10 million, follows with RM50 million next year, for poor farmers. It was just the beginning. Other cronies, who are Mahathir’s proxies, such as Vincent Tan, Ananda Krishnan and even his own sons Mirzan and Mokhzani could be next. - FT

cheers.

Sumber asal: PNB dgn menara pencakar langit tapi pelabur dapat "ciput"...

{ 0 comments... read them below or add one }

Post a Comment